36% of all active satellites in orbit are now owned by Starlink, with more than 1,750 active Starlink satellites currently in orbit according to data obtained by CeleTrak.

The news comes as Starlink, a set of internet satellites owned by SpaceX, recorded a 27th successful launch for the Falcon 9 flight. Starlink has plans for 42,000 strong constellations of satellites.

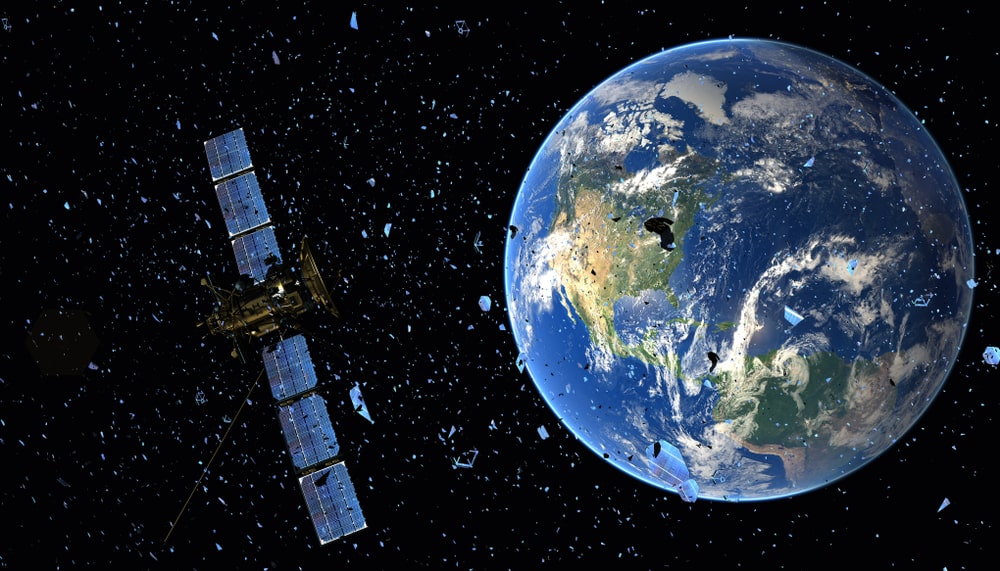

Starlink’s rapid boom in producing satellites has created concerns from scientists about the increased risk of collisions but it has also astronomers worried.

A report by the Satellite Constellations 1 (Sat Conn 1) found that constellations of bright satellites will fundamentally change ground-based optical and infrared astronomy which could impact the appearance of the night’s sky for stargazers around the world.

SpaceX secured a multi-billion deal with NASA, beating Blue Origin, but Musk warned that delays in the next-generation Starship Rocket may create a risk of bankruptcy for the company.

“If a severe recession were to dry up capital availability / liquidity while Space X was losing billions on Starlink and Starship, then bankruptcy, while still unlikely, is not impossible”, Musk tweeted.

So far, there has been only one successful high-altitude launch and landing of Starship to date with plans in place to perform first orbital flight early next year.

The long-term goal of SpaceX is to mass produce space craft to transport people and cargo around the solar system, eventually establishing a permanent human colony on Mars.

Insurers should be wary of pulling coverage from evolving risks and offer corporates “resilience insights”, was the verdict of a recent panel discussion at the Insurance Information Institute’s Joint Industry Forum in New York.

The panel discussed how insurers can help corporates, governments and the public develop a resilience framework in tackling issues such as cyber threats and extreme weather.

“Everyone is asking what is important to your market and what is top of mind. My response is it is the same thing that is top of mind to global economies, and I am putting it in the categories of the three C’S – Climate, Cyber and Capital. And you could throw in another, C for COVID”, added John Huff, president and CEO of the Association of Bermuda Insurers and Reinsurers.

While resilience-proofing their businesses, insurers can help pass on these insights onto corporates who are desperate to improve their resilience to new and complex risks.

“Our customers are craving insights. This is an evolving risk and some of it is insurable and some of it is not. But they are looking to us for data and trying to help them manage that expectation for sustainability in their organisation”, Paul Horgan, head of US national accounts at Zurich North America.

Furthermore, changes in risk exposure from resilience-related issues may prove to be a big challenge for the industry, Horgan added.

“In general, we look at it as when risk rises that could be good for the insurance industry as it is an opportunity to bring capital and bring our expertise…. The challenge is when risk becomes systemic and grows everywhere, and that is when you do need to partner with the government.

Zurich’s recent proposal of a public private partnership with governments to protect against future pandemic was cited as a good example of this.

Yet, Mr Huff did note some concern about changes in risk coverage stating, “I have heard some pretty strong arguments that we do have to remember that we are in the risk business and if there is a move to just a fee-based business that changes the perception of our business a bit”.

Related Articles

Reinsurance

Reinsurance

Reinsurance