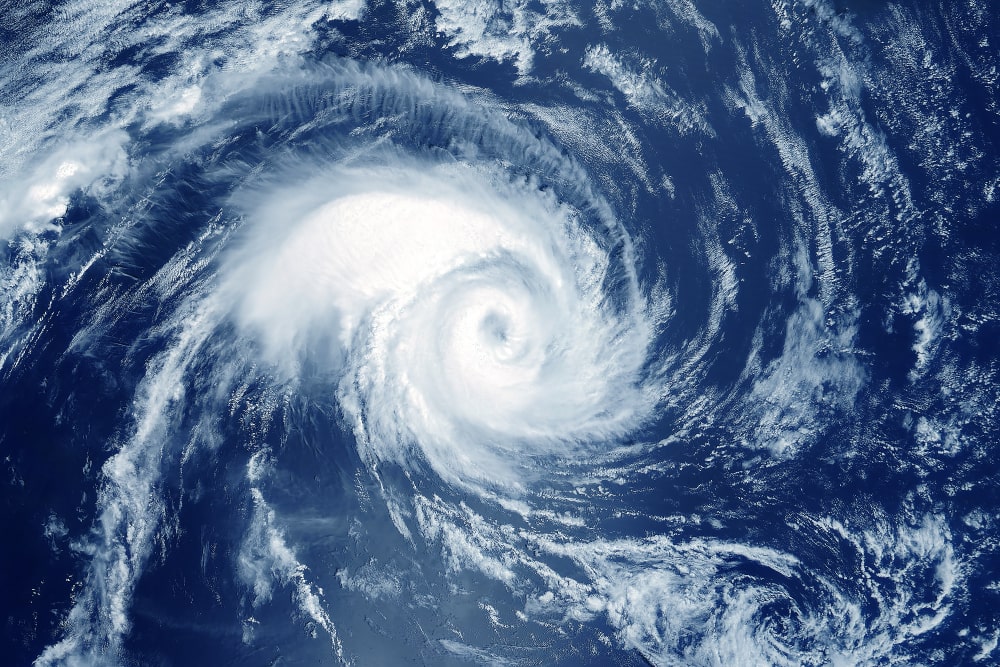

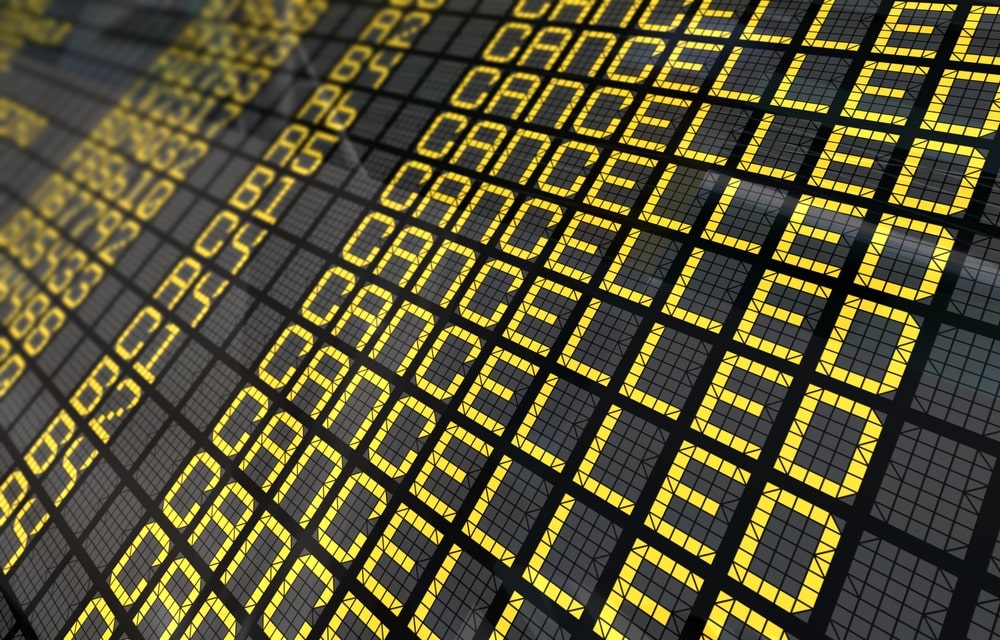

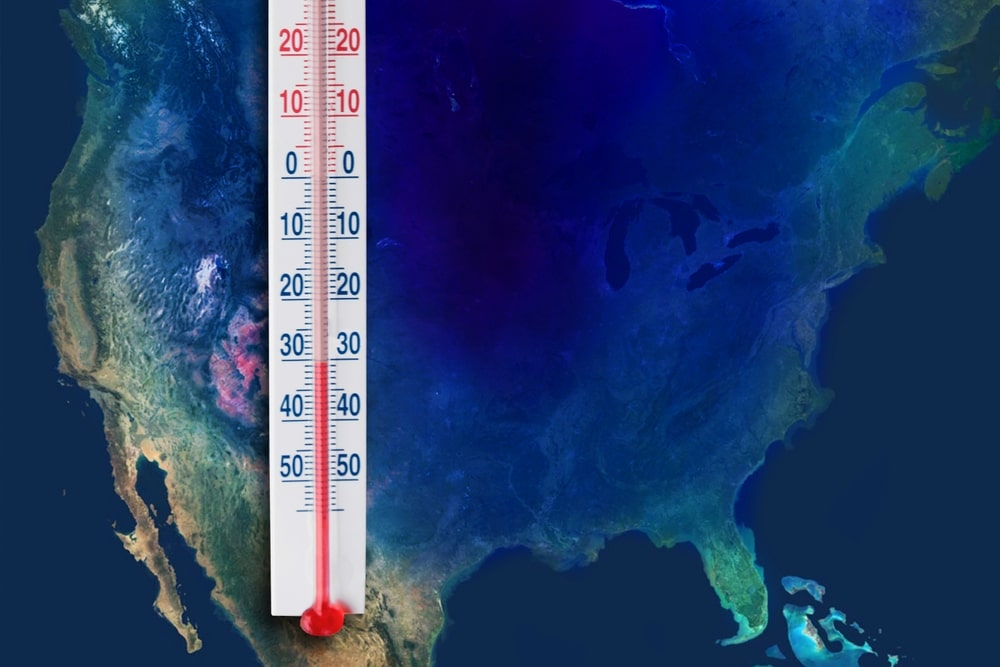

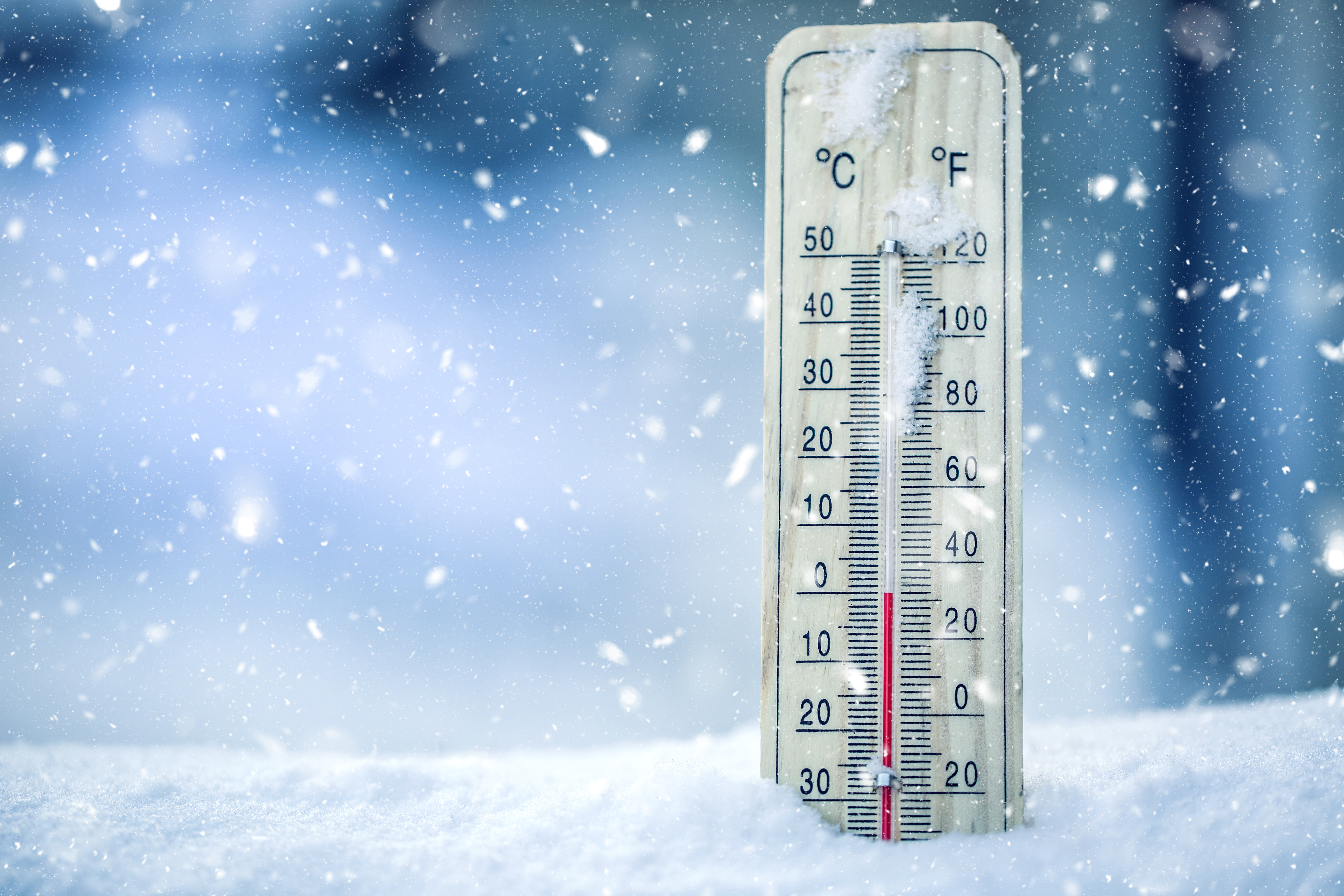

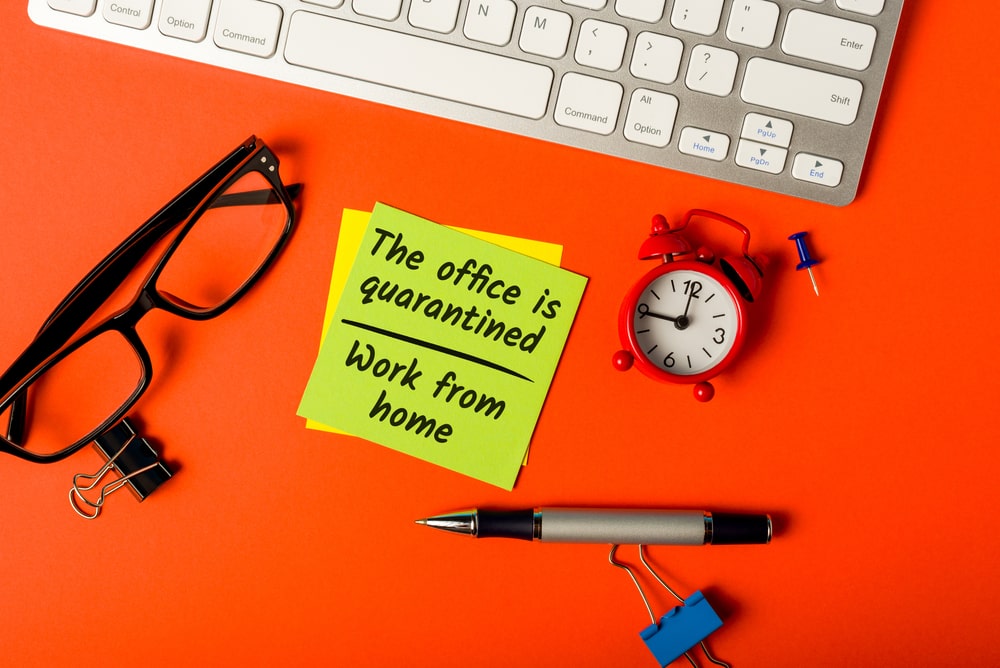

U.S. Extreme Temperatures Shut Down Events from San Antonio Monster Jam to Mamma Mia! on Broadway

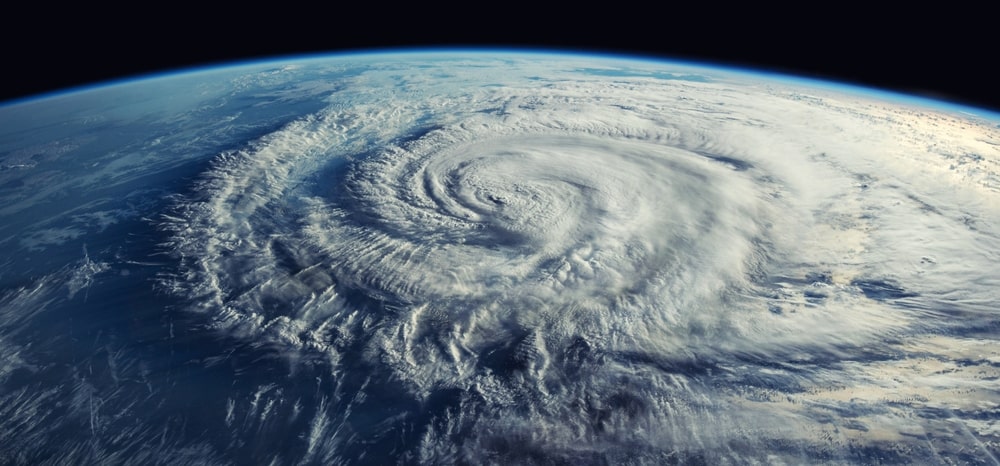

Fears of global warming are real but that doesn’t mean that very large local geographies will not continue to experience extremely cold temperatures, as the current weather in the U.S. shows.