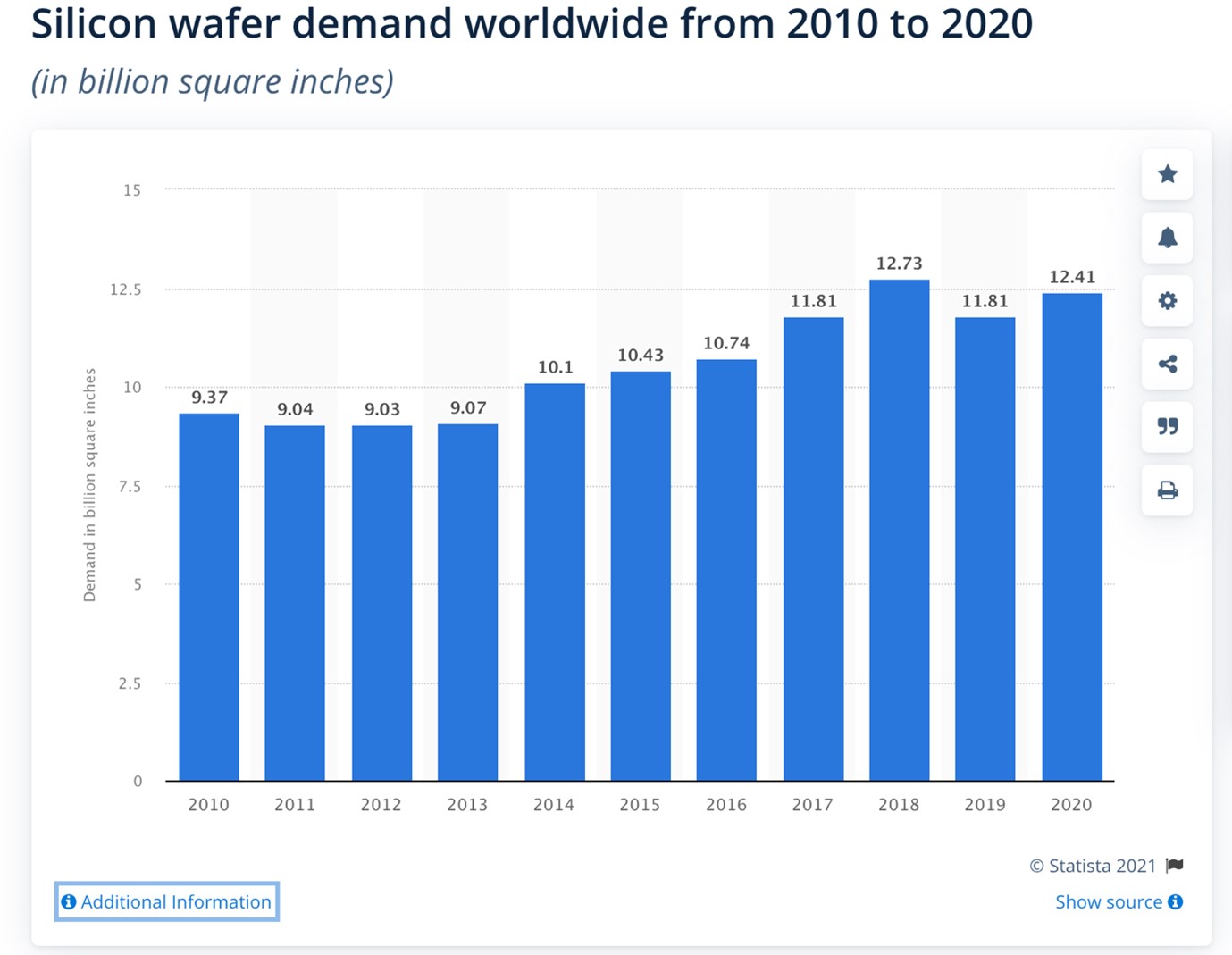

In 2020, global demand for silicon wafers reached 12.41 billion square inches, up from the 11.81 billion square inches that was recorded in the previous year.

(graph sourced from Statista)

By 2024, the leading application within the global semiconductor industry is expected to be smartphones, particularly the continued development of image sensors in such devices. In 2019, the smartphone semiconductor market was valued at 106 billion U.S. dollars, with projections suggesting this is likely to rise to 155 billion U.S. dollars.

Over the last decade, revenues generated by the global semiconductor industry have steadily increased, surpassing 440 billion U.S. dollars in 2020. This represented a rebound from the decline experienced in the previous year, with growth in 2020 coming despite the impact of the coronavirus pandemic on the global economy. In the coming years, semiconductor market revenues are expected to grow further.

Just as semiconductor market revenues have increased over the last decade, so too have total unit shipments. In 2020, semiconductor shipments amounted to over one trillion units – a 40 percent jump from the figure recorded in 2010. New market drivers and applications continue to emerge and have helped contribute toward a rise in semiconductor shipments.

The impact on the world’s resources is likely to be profound and will contribute to the shape of the new cold war and geopolitical instability over the coming decade and beyond.

Increasingly in the corporate world, scenario planning helps decision-makers identify outcomes and impacts, evaluate responses and manage risks and opportunities. This is becoming more essential as connected risk is driving up the complexity of event.

By imagining these potential risks and opportunities, Russell Group believes it is possible to create processes that allow businesses to become proactively alert. Our aim is to bring together a group of partners that can enable a business leader to plan and mitigate against a number of scenarios that threaten the viability of that business, and by doing so, secure the balance sheet. This would include insurers, reinsurers, risk managers and alternative risk transfer markets.

That concludes our series of blogs to coincide with the COP 26 UN Climate Change Conference.

Related Articles

Corporate risk

Corporate risk

Corporate risk